Tailored planning for your retirement goals

We find ‘a comfortable retirement’ is a common objective within our clients’ Life Plan and naturally an essential component of our Wealth Management.

Our team of independent financial advisers take a structured and intelligent approach to helping you plan for your retirement. This includes helping you set clear retirement goals, evaluating any existing pension arrangements you hold and creating a tailored funding plan to achieve these within your preferred time horizon.

Your Life Plan brings together both the ‘accumulation’ and the ‘decumulation’ phases – to build sizeable pension funds and then draw benefits in a highly tax-efficient and cost-effective manner. We achieve this by constructing the optimal investment portfolio combined with a single or blend of market leading retirement vehicles.

We’ll also ensure you have full visibility of your investment portfolio in both phases, by enabling you to have secure, real time information at your finger tips.

We would prefer to form a long-term relationship with you and we would like to meet you regularly to review things, to ensure things remain on track and to make any alterations as required.

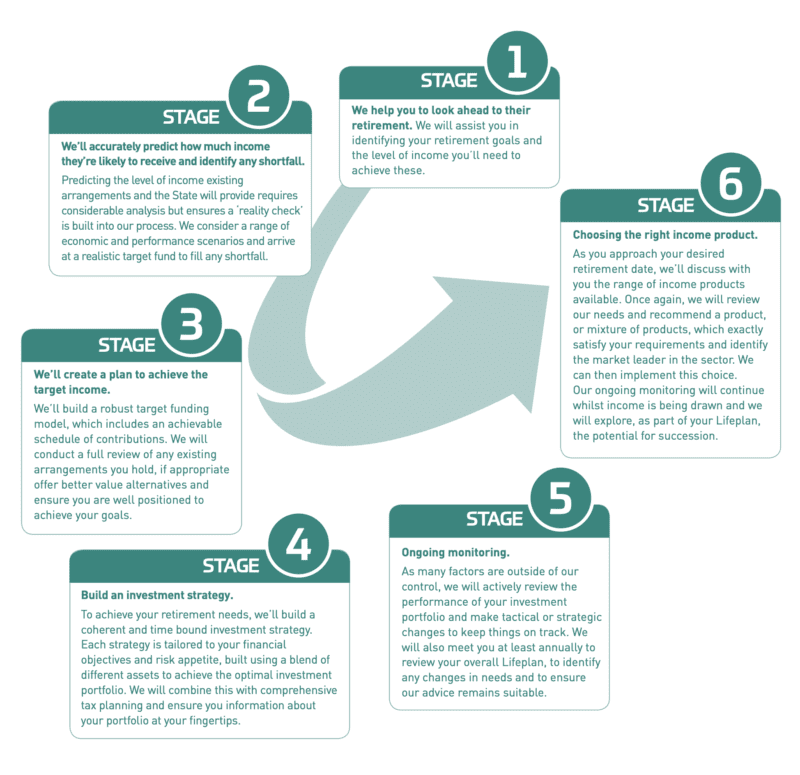

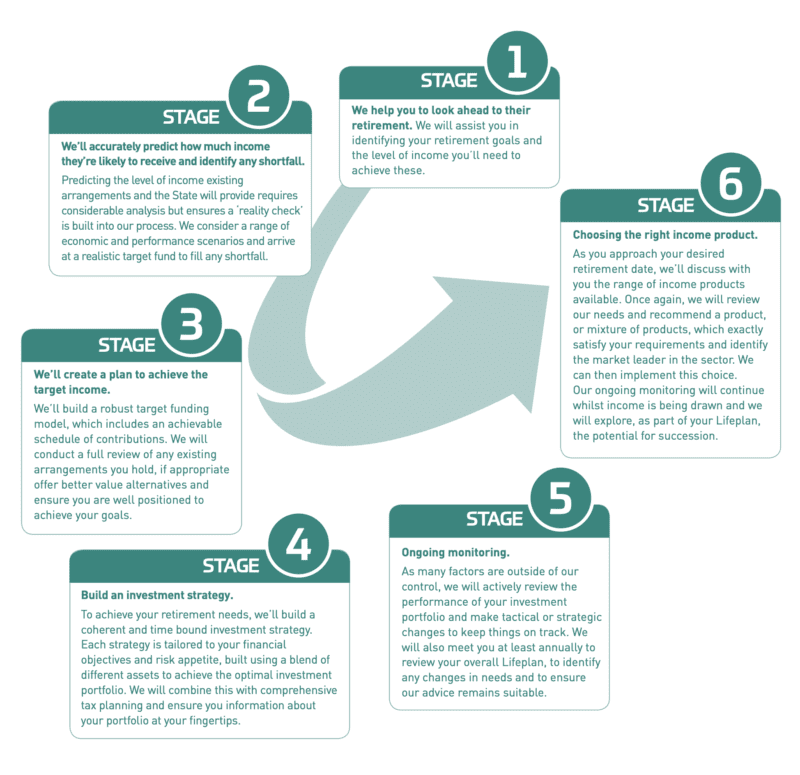

The following explains our approach at high level. It comprises of distinct stages starting with goal setting and then choosing the right income vehicle and ongoing reviews whilst you’re in retirement.

///

Retirement Advice Process

Retirement Advice – what to expect

Step 1 – We help you to look ahead to your retirement

We will assist you in identifying your retirement goals and the level of income you’ll need to achieve these.

///

Step 2 – We’ll accurately predict how much income you’re likely to receive and identify any shortfall

Predicting the level of income existing arrangements and the State will generate requires considerable analysis but ensures a ‘reality check’ is built into our process. We consider a range of economic and performance scenarios and arrive at a realistic target fund to make up any shortfall.

///

Step 3 – We’ll create a plan to achieve the target income

We’ll build a robust target funding model, which includes an achievable schedule of contributions. We will conduct a full review of any existing arrangements you hold, if appropriate offer better value alternatives and ensure you are well positioned to achieve your goals.

///

Step 4 – Build an investment strategy

To achieve your ‘comfortable retirement’, we’ll build a coherent and time bound investment strategy. Each strategy is tailored to your financial objectives and risk appetite, built using a blend of different assets to achieve the optimal investment portfolio. We will combine this with comprehensive tax planning and ensure you have access to information at your fingertips.

///

Step 5 – Ongoing monitoring

As many factors are outside of our control, we will actively review the performance of your investment portfolio and make tactical and strategic changes to keep things on track. We will also meet you at least annually to review your overall Life Plan, to identify any changes in your needs and circumstances to ensure our advice remains suitable.

///

Step 6 – Choosing the right income product

As you approach your desired retirement date, we’ll discuss with you the most tax efficient and cost-effective way of drawing your retirement savings. Once again, we will review your needs and recommend a product, or a mixture of products, which exactly satisfy your requirements and identify the market leaders in the sector. We can then implement your choice.

Our ongoing monitoring will continue whilst income is being drawn and we will explore, as part of your Life Plan, the potential for passing on unused funds if this is desirable.

We feel we are approachable. So, if you would like to discuss the possibility of becoming one of our clients, please get in touch. Our team of financial advisers are ready to help. We look forward to welcoming you to Grosvenor Wealth Management.