The abundance of financial resources and advice available, while useful, comes with a challenge in itself – knowing which information you can trust.

Long story short, it can be somewhat difficult to really know what’s what. In this article we break down some of the most common myths that our team sees and hears quite often.

Below are six financial planning myths that you need to stop listening to.

You don’t need a financial plan

If you want to succeed and reach your goals, you absolutely need a financial plan. Having a financial plan is no longer a consideration, it’s a must. Your plan is the ultimate financial tool that will help you navigate towards future financial success.

Without a proper plan, navigating your finances can feel daunting. Your plan simplifies things by keeping you on track and showing you the next steps you need to be making. Remember, failing to plan is planning to fail. When it comes to your finances, you’ll realise just how true this is.

A budget is a financial plan

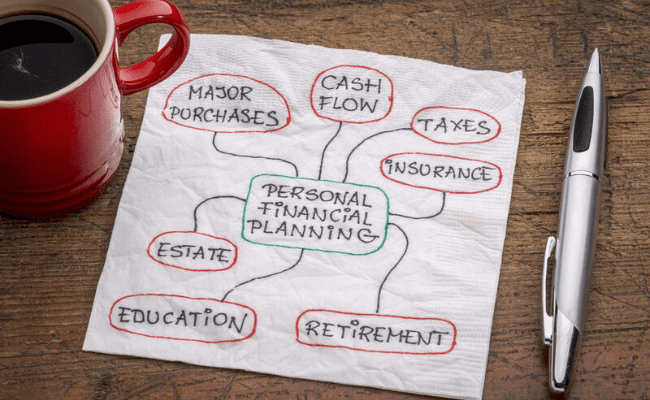

A financial plan is much more than a budget, although spending and savings are one of the major areas included in your plan.

While there is certainly some overlap between a budget and a financial plan, make sure that you’re not confusing one for the other. A budget is specifically designed to track your spending and saving habits, helping you become more efficient with your personal cash flow.

A financial plan on the other hand, encompasses all of the areas of your financial life. From savings, spending, income, and housing, to insurance, estate plans, and retirement, your financial plan will pave the path to help with tough financial decisions and give you insight on how you can better manage each area with confidence.

My adviser will take care of everything

Your financial adviser, or financial planning platform, isn’t a magic solution. While there are a lot of things your financial adviser can provide, it’s not a be-all, end-all solution. At the end of the day, it’s entirely up to you to make sure that you’re taking action, improving your financial literacy, and taking those critical next steps you need to in order to inch closer to your goals.

When you start realising that it starts and ends with you, it becomes even more of a motivating piece to take things into your own hands.

I can do it all on my own

It would be time consuming and difficult to handle everything on your own. While there are a lot of things you can and should take into your own hands, it would be unwise to think that you would be able to handle everything on your own when it comes to your personal finances.

At some point or another you will require some level of intervention and support from additional tools, services, and financial professionals.

Financial planning is only for the wealthy

Financial planning is for everyone. If you earn an income, manage expenses, or have some level of financial responsibility, then financial planning is a must.

Traditionally speaking, financial planning, and more so investing, was reserved only for six-figure earners with substantial money in their accounts. However, thanks again to the combination of technology and transparency in the industry, that’s no longer the case.

This belief is a real retirement killer for far too many households as it prevents many from getting started with financial planning in the first place. The thing to remember is this; everyone starts at the same place–with £0 in any investment or savings vehicle until they make their first investment.

Once you have a plan, you’re all set

Financial planning is an ongoing commitment to your financial success. If you’re serious about reaching your goals and making significant improvements, it’s important to understand that financial planning isn’t a one-and-done type of deal. It requires constant upkeep and maintenance to make sure you are staying on track.

Once you create your financial plan, it’s critical that you take the next steps and continue working on taking action and making strides to improve your situation.

We recommend reviewing your plan monthly and updating your financial profile at least every three to six months. A lot can happen in the span of a few months and frequently checking in will make sure that your plan is still accurate and on track with your current lifestyle and goals.

If you would like to know more about financial planning or wish to discuss your own financial goals and strategy with us, then we’d be delighted to hear from you. Please get in touch using the details below, to arrange a free, no-commitment financial consultation with a member of our team.

PLEASE NOTE: Grosvenor Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. The Financial Conduct Authority do not regulate tax planning, estate planning, or wills. The value of investment can go down as well as up and you may not get back the original amount you invested. Tax treatment is dependent on individual circumstances and may be subject to change. Tax planning is not regulated by the Financial Conduct Authority.

Contact Us Form

Please complete this form if you wish to send us your questions or if you would like to request a call back.

We look forward to speaking with you.

Recent GWM articles that may be of interest

Smart Money May / June 2025

Smart Money May / June 2025 Welcome to the May / June 2025 edition of [...]

Smart Money March / April 2025

Smart Money March / April 2025 Welcome to the March / April 2025 edition of [...]

Taking the road to a comfortable retirement

Achieving this vision requires careful planning and preparation We all dream of a comfortable retirement, [...]

Practical financial planning for busy mums

The road to robust financial health, even when you’re juggling the demands of family life [...]

Planning for the future of your wealth

How to integrate emotional, financial and practical dimensions When it comes to your legacy, wealth [...]

Pension funds and the path to net zero

Survey pinpoints several barriers threatening pension funds’ progress Sixty-five per cent of pension funds recently [...]