Wealth Management

Trusted advice to achieve your goals

What is Wealth Management?

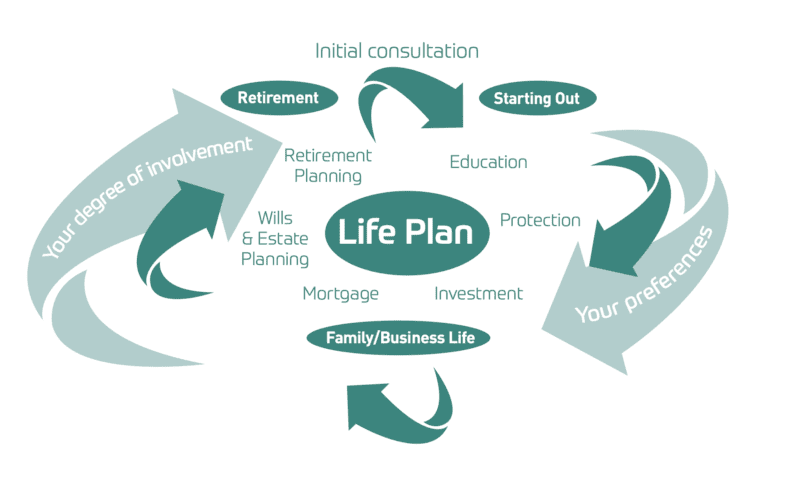

Wealth Management is a holistic advisory service which combines a range of inter-linking financial services to address a client’s long term financial needs and goals.

Why is Grosvenor Wealth Management the right Wealth Manager for you and your family?

Our approach to Wealth Management ensures that you are more confident about your goals. Our coherent and complementing advisory services helps you to set ambitious but achievable financial goals and our advice services ensure you achieve these.

Firstly, we’ll gain a comprehensive understanding of your circumstances and any financial arrangements that are already in place.

We’ll then engineer a coherent and sustainable Life Plan which ensures the achievement of your goals by blending our expertise in inter-generational inheritance tax planning, retirement planning, property ownership, investment management, mortgages and different forms of life assurance.

As an Independent Financial Adviser firm, we research, analyse and combine suitable market-leading financial products from the entire marketplace for you. We will then actively monitor and challenge these product providers on their performance to ensure you receive the best possible outcome.

We aim to take over the weight of managing your wealth using our Life Plan, although we are very sensitive to the extent that you wish to participate in the process. We can simply provide technical advice and guidance to help you make your own financial decisions, if this all you need.

Whatever flavour of wealth management you are seeking, we will deliver a service which is uniquely tailored to your needs and underpinned by our reputation for having the highest standards of financial advice and ethics.

We can manage the wealth of one individual, a couple or a whole family. It’s your choice. If you would like to discuss the possibility of becoming one of our clients, please speak to us. We look forward to welcoming you to Grosvenor Wealth Management.

News & Articles

Understanding fixed interest investing

Looking for a steady approach to building your portfolio? Bonds can provide stability and income for your investment strategy. They are often viewed [...]

Trump’s tariffs create turbulence in global markets

Remaining focused on established investment principles is essential The first quarter of 2025 has been anything but steady for global markets. With the [...]

Transferring wealth to the next generation

What to consider when planning your legacy Transferring wealth to the next generation is one of the most important financial decisions you will [...]

Testimonials

“The team at Grosvenor have really helped us think through our options for different scenarios and created us a versatile financial plan. Great practical and knowledgeable advice. Thank you.”

“Attention to detail and nothing is ever too much trouble”

“They have the ability to support me across an unusually wide breadth of services including estate planning. Fundamentally I trust GWM and I see this as a long-term relationship for my whole family”

“I feel empowered and more optimistic about moving on to the next phase of my life.”

“Grosvenor were the outstanding exception in doing what they promised without fuss and within the timescale promised. Thank you very much for your help. After the sale of another property later this year, we look forward to reinvesting the money with you.”