Investment Advice

Managing investments towards your Life Plan

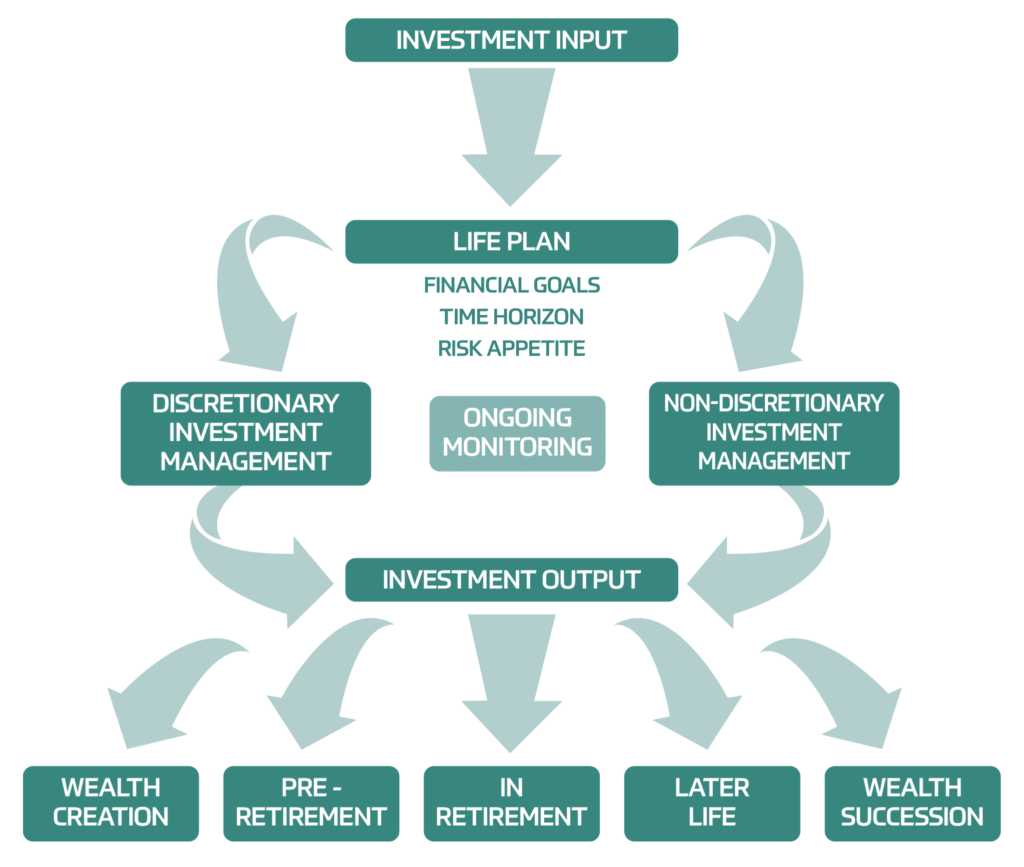

Our investment advice is central to providing sustainable Wealth Management and forms an integral part of your Life Plan.

Our view is that the best performance is one which gives you the right outcome. Our investment expertise focuses on delivering a high degree of predictability and ultimately value in return for risk.

Depending on your needs and preferences, we can construct an investment portfolio for you using a wide range of investment solutions and either make investment decisions on your behalf or simply make recommendations. The choice is entirely yours.

We will monitor the performance and volatility of your portfolio. Our aim is always to balance any downside risk with the necessary investment return to fuel your Life Plan. The following provides a high level view of our approach.

///

Our Investment Advice process

///

Our investment advice approach in more detail:

- We help you to set realistic investment objectives and time horizon which are aligned to the key financial goals within your Life Plan.

- We will ascertain your attitude to investment risk (your risk profile) and capacity to absorb any market fluctuations.

- We will then construct an investment portfolio which is aligned to your risk profile which is engineered to achieve target returns within your specified risk banding.

- We always ensure that your investment portfolio is managed tax efficiently and enable you to receive secure, real time information about the performance of your investment portfolio.

- As markets can move quickly, your investment portfolio is regularly reviewed and minor adjustments are made promptly on an ongoing basis.

- To achieve a coherent and coordinated financial solution, it’s important to meet you at least annually to review your Life Plan; at the same time we will analyse the performance of your investment portfolio, to ensure it remains on track and aligned to your risk profile. We will then recommend any modifications as required.

We feel we are approachable. So, if you would like to discuss the possibility of becoming one of our clients, please get in touch. Our team of independent financial advisers are ready to help. We look forward to welcoming you to Grosvenor Wealth Management.

Investment Risk Warnings

- Past performance is used as a guide only. It is no guarantee of future returns.

- The fund value of your investment and any income it provides can go up and down, and you may not get back the full amount invested.

- Charges, including Adviser Charges, will reduce the returns you receive on your investments and over time can have a significant impact on your investments.

- Other than deposit-based savings, investments should be viewed over the medium to long term – a period of 5 years plus.

- If you transfer or surrender the plan, especially during the early years, the fund value may be less than you have invested.

- The investment growth rates used by companies in their illustrations are not minimums or maximums and offer no form of guarantee. The returns achieved may be less than those illustrated.

- Certain asset classes and funds will perform better than others and the asset allocation will change unless it is regularly rebalanced.

- The capital value of your investment will be eroded if withdrawals exceed the net growth of the underlying investments.

- Inflation will reduce the real value of your investment and any income over time.

- In exceptional circumstances it may take some time to realise the full value of certain underlying assets, such as funds that invest in property and / or hedge funds.

- An investment in corporate bonds is generally less secure than an investment in Government bonds due to the greater possibility of default.

- Currency exchange rates can cause the value of investments, as well as any income they provide, to fall as well as rise.

Testimonials

“The team at Grosvenor have really helped us think through our options for different scenarios and created us a versatile financial plan. Great practical and knowledgeable advice. Thank you.”

“Attention to detail and nothing is ever too much trouble”

“They have the ability to support me across an unusually wide breadth of services including estate planning. Fundamentally I trust GWM and I see this as a long-term relationship for my whole family”

“I feel empowered and more optimistic about moving on to the next phase of my life.”

“Grosvenor were the outstanding exception in doing what they promised without fuss and within the timescale promised. Thank you very much for your help. After the sale of another property later this year, we look forward to reinvesting the money with you.”

Related Articles

Understanding fixed interest investing

Looking for a steady approach to building your portfolio? Bonds can provide stability and income for your investment strategy. They are often viewed [...]

Trump’s tariffs create turbulence in global markets

Remaining focused on established investment principles is essential The first quarter of 2025 has been anything but steady for global markets. With the [...]

Transferring wealth to the next generation

What to consider when planning your legacy Transferring wealth to the next generation is one of the most important financial decisions you will [...]