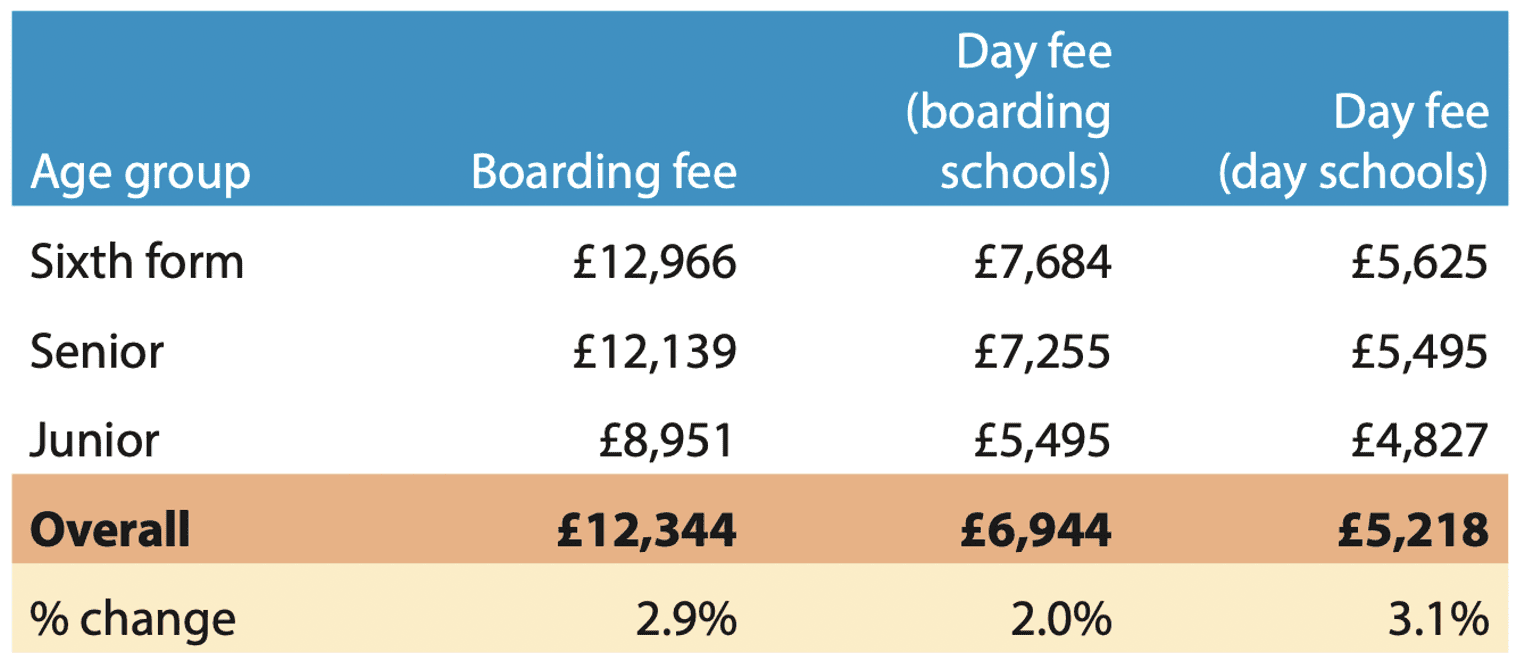

Children will soon be back at school for a new academic year. For those parents who have opted for private education, they have only seen their fees rise significantly in the last few years. According to figures released in the Independent School Council’s Annual Census, in 2022, private school fees per term for primary age pupils ranged from £4,827 to £8,951, depending on board, and for Sixth Form pupils this rises to £5,625 to £12,966 per term.

With these costs only set to increase in the current economic climate, it is worth considering the tax-efficient strategies that are available to grandparents to ease the education costs of their grandchildren.

The wealth gap

As we discussed in our recent article on intergenerational planning, there is a considerable wealth gap between generations, with ‘baby boomers’ holding the majority of assets. Unfortunately, handing over this wealth is not always straightforward, particularly when it comes to Inheritance Tax liabilities that can result from large gifts. However, if grandparents are in the fortunate position of being able to assist with education costs, this can prove a valuable way in which to gift your estate within the boundaries of IHT.

IHT annual gift allowance

Each grandparent has an annual IHT gift allowance of £3,000, which can be carried forward for one year if unused. Therefore, a couple could make an annual gift of £6,000 with no IHT consequences.

Grandparents also have the option to make regular payments to support someone else’s living expenses up to any value that could be exempt from IHT, provided they can prove that the payments are from excess income. To be exempt from IHT, these must be regular payments, rather than a one-off gift.

Larger amounts can also be gifted and will be free of IHT if the donor survives for seven years after making the gift. If they die before the seven years is up and there’s IHT to pay, the rate of tax will depend on how much time has elapsed since they made the gift. If it’s less than three years, then IHT is payable at 40%. If it’s more than three years, there’s a sliding scale to determine how much tax is owed.

Using Discretionary trusts

An individual can give up to £325,000, (the full amount that is free of IHT), to a discretionary trust without triggering an IHT liability. This will need to be checked against any gifts that have been previously made. As with larger gifts, it will take seven years for the gift to fall outside of the person’s estate. However, once the seven years is up the £325,000 nil rate band is effectively ‘regenerated’.

This can make for a significant contribution towards education costs. For a couple with full funds available, they could set up a discretionary trust with capital of £650,000, with the grandchildren as the beneficiaries. From here, discretionary payments can be made to help with school fees as required.

This option can be particularly tax-efficient as alongside the IHT saving of 40%, there are potential income tax advantages for the trust’s beneficiaries as the trustees can make use of the income tax and Capital Gains Tax allowances of the grandchildren.

It should be noted that establishing this kind of trust is complicated and we would strongly advise seeking financial and legal advice as getting it wrong can be costly.

For grandparents with concerns about their own inheritance tax liability and a desire to help with their grandchildren’s education costs, there are clear opportunities to address both issues together and benefit the next generation today.

Talk to us

There are many considerations to take into account when it comes to Inheritance Tax planning and each plan must be uniquely tailored to your family’s needs and financial goals. It is, therefore, important to speak to a specialist financial planner to get independent advice on what strategies will work best for you and your family.

PLEASE NOTE: Grosvenor Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. The value of investment can go down as well as up and you may not get back the original amount you invested. Tax treatment is dependent on individual circumstances and may be subject to change. Tax planning is not regulated by the Financial Conduct Authority.

Contact Form

Please complete this form if you wish to send us your questions or if you would like to request a call back.

We look forward to speaking with you.

Recent GWM articles that may be of interest

The future of retirement

Experiences of the past and potential future scenarios The latest research reveals a significant disparity [...]

Take your pension to the max

Do you have potential shortfalls and need to address these gaps? First and foremost, let’s [...]

Empowered savers

How to make future aspirations more attainable and less stressful Saving can bring you a [...]

Building wealth and achieving financial goals

Aligning investments with risk tolerance and capacity Investing is an indispensable tool for building wealth [...]

Time to revisit your retirement plan?

Helping you feel more prepared for this stage of your life If you are in [...]

The middle-aged squeeze

Juggling careers, family care and financial pressure amid rising costs and wealth transfers Increasing longevity [...]