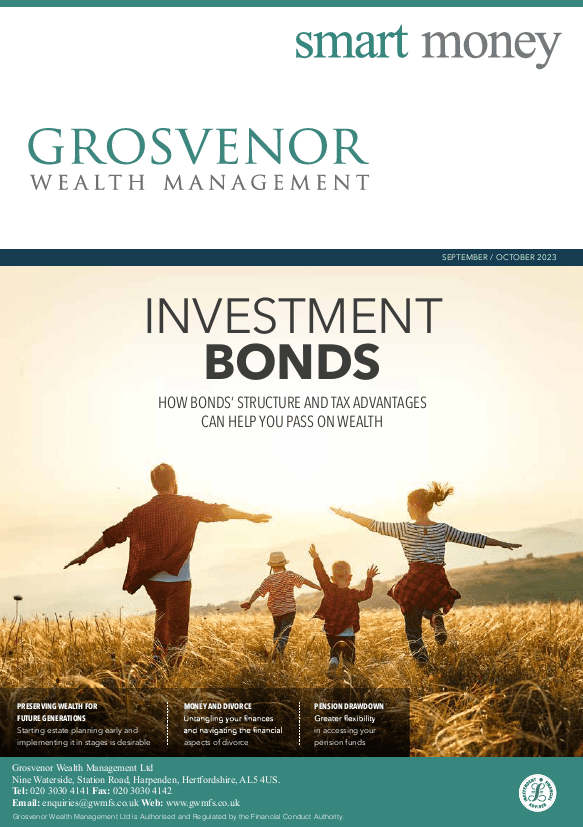

Taking a look at Investment Bonds

Welcome to the September/October 2023 edition of Smart Money.

In this issue, we look at investment bonds and explain how they offer several benefits that some investors may be missing out on, which have become even more beneficial due to recent changes in tax regulations. This follows last November’s Budget and the Chancellor’s decision to reduce the Capital Gains Tax

(CGT) Allowance from £12,000 to £6,000 this year and to £3,000 in April 2024. This is likely to increase the appeal of investment bonds for some investors who want to minimise Inheritance Tax (IHT) liabilities when passing on wealth. Read the full article on page 06.

The UK Treasury has been receiving record-breaking Inheritance Tax (IHT) receipts. IHT receipts amounted to approximately £7.09 billion British pounds in 2022/23, compared with £6.05 billion in the previous financial year, according to Statista. On page 03, we consider why IHT can be emotionally challenging for individuals and families who have to pay it, often requiring the sale of cherished family assets to settle the tax bill. That’s why starting estate planning early and implementing it in stages is essential.

Divorce is a complex process that often comes with various financial considerations and preparing for a divorce is undoubtedly challenging, especially when it involves untangling your finances. The emotional strain can make it difficult to make clear-headed decisions and the long-term consequences may not be immediately apparent. On page 11, we explain why it’s crucial to carefully consider the financial aspects of divorce to ensure that you can sustain the lifestyle you desire post-separation.

Pension drawdown is a flexible way of taking income from your pension, introduced after the pension freedom rules in April 2015. Before that, the government limited how much income you could take from your pension unless you had other sources of income, and annuities were commonly used to provide a guaranteed income for life. Nowadays, you have more flexibility in accessing your pension funds, allowing you to take as much or as little as you want. Turn to page 12 to read the full article.